IRS 8868 2025-2026 free printable template

Instructions and Help about IRS 8868

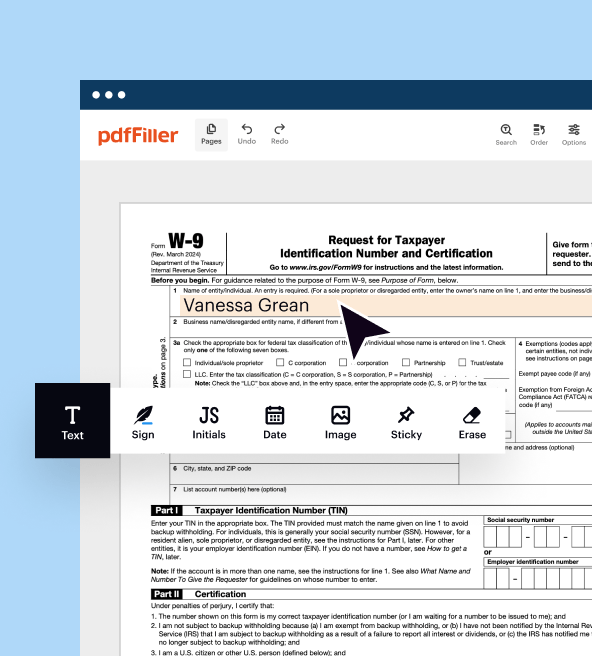

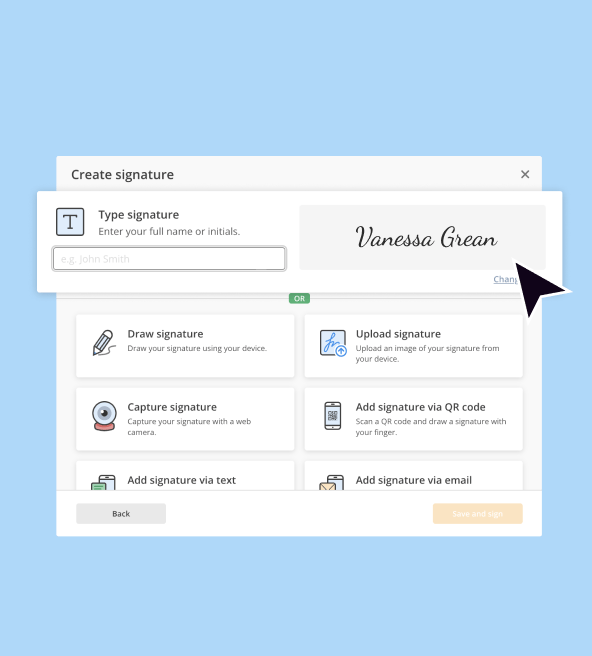

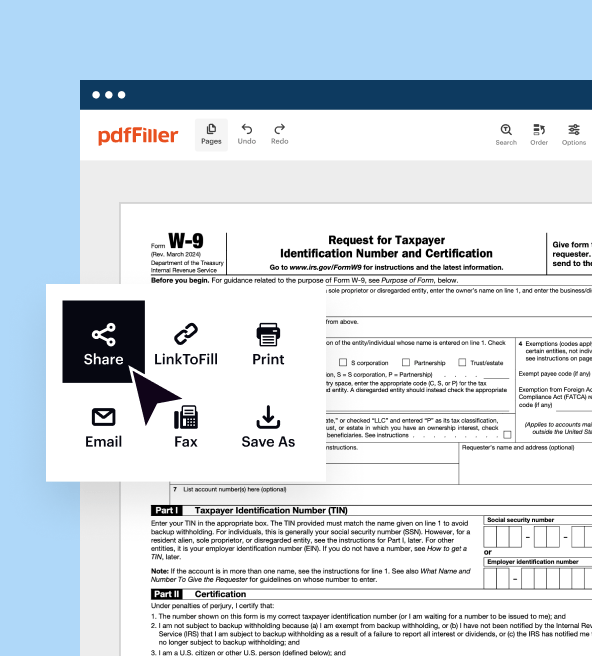

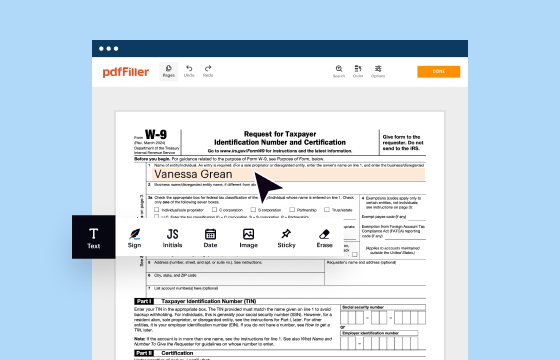

How to edit IRS 8868

How to fill out IRS 8868

Latest updates to IRS 8868

All You Need to Know About IRS 8868

What is IRS 8868?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8868

What should I do if I realize I've made an error after submitting IRS 8868?

If you've submitted IRS 8868 and discover an error, you can file an amended form to correct it. Ensure you include explanations for the changes made to prevent further complications. It's advisable to check the IRS guidelines on how to properly amend submissions to avoid delays in processing.

How can I verify the status of my IRS 8868 submission?

To check the status of your IRS 8868, you can use the IRS's online e-filing status tool. If you filed by mail, allow ample time for processing and consider contacting the IRS directly if you haven’t received confirmation in a reasonable timeframe.

Are there specific privacy concerns I should be aware of when filing IRS 8868?

When filing IRS 8868, be mindful of data security and privacy. Ensure that your electronic submission is through secure channels and remember to retain copies of sensitive information in a safe location. Understanding how the IRS handles your data can also enhance your security practices.

What special considerations exist for nonresidents filing IRS 8868?

Nonresidents must be aware of specific filing requirements when submitting IRS 8868, including potential tax treaty implications and specific forms they may need. It's advisable to consult a tax professional familiar with international tax issues to navigate these complexities effectively.

What should I do if my e-filing of IRS 8868 gets rejected?

If your e-filing of IRS 8868 is rejected, review the error codes provided and make the necessary corrections. After addressing the issues, you can resubmit the form electronically. Keeping track of rejection reasons can help you prevent similar issues in future filings.